39+ Mortgage calculator total interest paid

PMI typically costs from 035 to 078 of the loan balance per year. Our mortgage calculator helps by showing what youll pay each month as well as the total cost over the lifetime of the mortgage depending on the deal.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

. Interest Paid Principal Paid Total Payment Remaining Balance. The maximum total dollar limit per customer is 500000. Deduction for medical expenses that exceed 75 of AGI.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Chart represents weekly averages for a 30-year fixed-rate mortgage. A Note on Private Mortgage Insurance.

Baca Juga

Are you remortgaging with the same lender or new lender. This is calculated as the home price less the down payment. Valuation fee and mortgage charge paid to the Property Registration.

The interest rate paid on. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan.

But with a 30-year FRM your total interest charges amount to 137636. The balance of the home loan or mortgage to be paid off. If you take a 10-year FRM youll save 104285 on overall interest costs.

Deduction for mortgage interest paid. Yearly or single payments. Special rates are offered only online and for a limited time.

A mortgage is one of the biggest commitments youll make in your financial life. Payment Date Payment Interest Principal Tax Insurance PMI. We then divide the total fees by the number of months the initial mortgage rate lasts to find the total fees per month.

Get 2 of your mortgage amount back in cash. Those who pay at least 20 on a home do not require PMI but homebuyers using a conventional mortgage with a loan-to-value LTV above 80 are usually required to pay PMI until the loan balance falls to 78. Over 170000 positive reviews with an A rating with BBB.

People typically move homes or refinance about every 5 to 7 years. The home loan calculator accounts for mortgage rates loan term down payment more. If a person.

Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Such as the dollar amount of the total mortgage including any down payment made mortgage default insurance if warranted the number of months or years the mortgage will be. Build home equity much faster.

Meanwhile with extra 100 per month you can remove 3 years and 4 months from the loan term. Note that making. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

The total interest savings will amount to 12438. Use the results to see how much can be saved by making extra payments in terms of interest paid as well as the reduction in loan term. For example the difference between taking out a 30-year fixed-rate 250000 mortgage with a 670 FICO Score and a 720 FICO Score could be 72 a month.

Deduction for charitable contributions. Youre better off staying with your current interest rate until your mortgage is paid off. Monthly Capital Interest Payment Breakdown.

Cash out debt consolidation options available. Early mortgage payoff calculator is easy to use and comes with an amortization schedule that shows you all the payment details. 15 2017 have this lowered to the first 750000 of the mortgage.

Mortgage Type Options. Monthly Capital Interest Payment Breakdown. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff.

This allows you to focus on comparing the difference in interest rate and total interest paid against the upfront fee for. This is based on a 200000 mortgage balance at 3 APR with overpayments made at the start of the loan. It will also save 6727 on total interest charges.

Historical mortgage rates chart. Mortgage loan basics Basic concepts and legal regulation. But with so many possible deals out there it can be hard to work out which would cost you the least.

With a 10-year FRM you only pay 33351 on total interest costs. Most commercial mortgage facilities charge a lender arrangement fee also known as a facility fee acceptance fee or booking fee which is usually a percentage of the mortgage amount being borrowed and added to the facility. Homes purchased after Dec.

Over the lifetime of the loan having a good score could save you 26071 in interest payments. Pay off higher interest rate credit cards pay for college tuition. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

Deals looking at annual cost you can see which one would be cheapest for you taking into account fees as well as the interest rate. Our mortgage calculator helps you estimate your monthly mortgage payments. This also applies to most 457 plans.

Interest paid on the mortgages of up to two homes with it being limited to your first 1 million of debt. Average for 2022 as of August 26 2022. Credit Certificate provides qualified borrowers with up to 2000 per year in a federal income tax.

However savings are more evident when we look at total interest charges. The table shows shorter loan terms generate less interest. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Borrow from 8 to 30 years. Cashback is not available with the High Value Mortgage fixed interest rate. Mortgage refinance calculator.

The annual cost only applies to the initial deal as its always best to consider switching. If applicable please enter the arrangement fee as a percentage this will then be added to the total mortgage facility. If you participate in a 401k 403b or the federal governments Thrift Savings Plan TSP the total annual amount you can contribute is increased to 19500 26000 if age 50 or older.

To estimate how much you can borrow use our mortgage affordability calculator. Use our mortgage calculator to calculate how much you can borrow or try our mortgage repayment calculator to estimate your monthly repayments. There may be an escrow account involved.

The other portion is the interest which is the cost paid to the lender for using the money. Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. Thats extra money you could be putting toward your savings or other financial goals.

Free VA mortgage calculator to find the monthly payment total interest funding fee and amortization details of a VA loan or to learn more about VA loans. Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff.

Free 10 Customer Payment Statement Samples In Pdf

Debt Service Ratios Gds And Tds Ratehub Ca

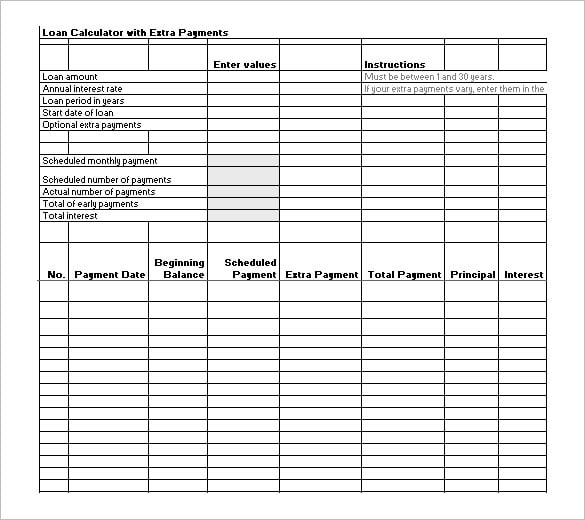

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Free Homework S Help 24 7

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Nowly Insurance Review Loans Canada

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Free Homework S Help 24 7

Cash Flow Analysis 16 Examples Format Pdf Examples

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

28 Sheet Templates In Word Free Premium Templates

Idbi Bank Offers Car Loans With Attractive Interest Rates For Upto 7 Years Calculate Your Eligibility And Get A Free Emi Quote Car Loans Car Finance Finance

Suppose That 12 000 Is Invested In A Savings Account Paying 5 6 Interest Per Year How Long Will It Take For The Amount In The Account To Grow To 20 000 If Interest Is

Taking Cpp Early Or Late How Long Until Breakeven Planeasy

Suppose That 12 000 Is Invested In A Savings Account Paying 5 6 Interest Per Year How Long Will It Take For The Amount In The Account To Grow To 20 000 If Interest Is